Understanding the concept of notional pay can be crucial, especially in the context of Indian payroll and taxation. “Notional pay meaning in Hindi” often translates to “मान्य वेतन” (maanya vetan) or “काल्पनिक वेतन” (kalpanik vetan), but a more accurate and context-specific translation is needed depending on the situation. This article delves deep into the meaning of notional pay, its various applications, and its implications in India.

What is Notional Pay?

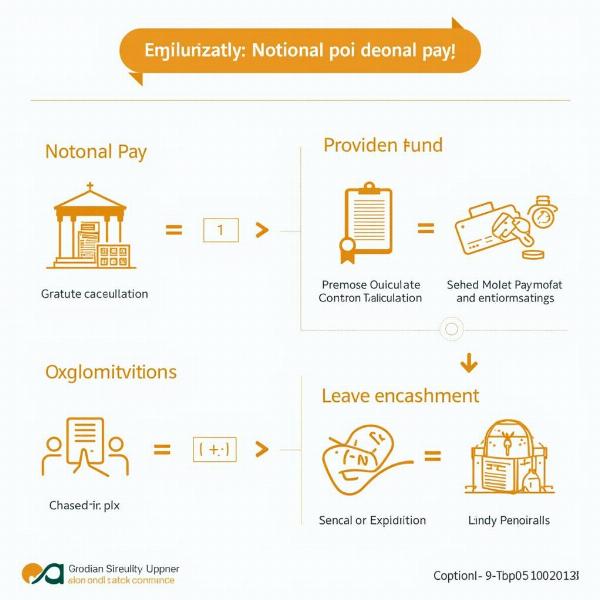

Notional pay refers to a hypothetical salary or income that is not actually paid to an employee but is considered for certain calculations, such as gratuity, provident fund contributions, or leave encashment. It’s a theoretical value assigned for specific purposes, despite not being part of the regular salary. It’s crucial to understand its difference from actual salary to avoid confusion. Understanding the concept is vital for both employers and employees, particularly when dealing with long-term benefits and tax calculations.

Applications of Notional Pay in India

Notional pay plays a significant role in various aspects of Indian employment and finance. Its applications range from calculating retirement benefits to determining loan eligibility. Here are some common scenarios where it comes into play:

-

Gratuity Calculation: Notional pay is often used as the basis for calculating gratuity, which is a lump-sum payment given to employees upon retirement or resignation after completing a certain number of years of service.

-

Provident Fund (PF) Contribution: In some cases, notional pay may be considered for determining the PF contribution, both from the employee and the employer.

-

Leave Encashment: When an employee encash their accumulated leave, the calculation might be based on their notional pay.

Applications of Notional Pay

Applications of Notional Pay

Notional Pay vs. Actual Salary: Key Differences

While both notional pay and actual salary are related to an employee’s compensation, they are distinct concepts. Understanding the difference is crucial for accurate financial planning.

-

Actual Salary: This is the amount an employee receives in hand after all deductions, including taxes, PF contributions, and other deductions. It’s the tangible income received regularly.

-

Notional Salary: This is a calculated figure used for specific purposes, like gratuity or leave encashment. It might not reflect the actual take-home pay.

Why is Notional Pay Important?

Notional pay plays a crucial role in determining an employee’s long-term benefits. It can significantly impact the gratuity amount received upon retirement or resignation. Moreover, understanding notional pay helps in making informed decisions about financial planning. It ensures transparency and clarity regarding various deductions and benefits associated with employment.

How is Notional Pay Calculated?

The calculation of notional pay can vary depending on the specific purpose and the organization’s policies. It often involves considering factors like basic salary, dearness allowance, and other applicable allowances. Consulting the company’s HR department or referring to relevant employment laws can provide clarity on the specific calculation method.

Conclusion

Understanding “notional pay meaning in Hindi” is vital for both employees and employers in India. Whether it’s calculating gratuity, understanding PF contributions, or planning for leave encashment, a clear grasp of this concept is essential for informed financial decision-making. This article has provided a comprehensive overview of notional pay, its various applications, and its importance in the Indian context.

FAQ

- What is the Hindi meaning of notional pay? The closest translations are “मान्य वेतन” (maanya vetan) or “काल्पनिक वेतन” (kalpanik vetan), but the specific term used can vary depending on the context.

- How does notional pay affect my gratuity? Notional pay is often the basis for calculating gratuity, directly impacting the final amount received.

- Is notional pay the same as gross salary? No, they are different. Gross salary is the total salary before deductions, while notional pay is a calculated figure used for specific purposes.

- Where can I find more information about my notional pay? Your company’s HR department can provide detailed information specific to your organization.

- Can notional pay be higher than my actual salary? Yes, it’s possible in certain scenarios, especially when considering allowances that are not part of the regular take-home pay.

- Does notional pay affect my income tax? Not directly. Notional pay is used for calculations like gratuity and PF, which have separate tax implications.

- Is notional pay always considered for PF contributions? No, it depends on the company’s policy and the specific regulations applicable.

Meaning-Hindi.in is your trusted partner for accurate and culturally sensitive Hindi translation services. We specialize in various translation domains, including business and legal documents, technical manuals, website localization, and academic papers. Our team of expert linguists ensures quality and precision in every project. For all your Hindi translation needs, contact us at [email protected] or call us at +91 11-4502-7584. Meaning-Hindi.in is committed to bridging the language gap and facilitating seamless communication.