Bank seeding refers to the initial capital required to start a bank or a financial institution. In Hindi, it is commonly referred to as “बैंक सीडिंग” (bank seeding) or “पूंजीकरण” (poonjeeकरण), which broadly translates to capitalization. Understanding bank seeding is crucial for anyone interested in the financial sector, especially entrepreneurs looking to establish new banking ventures. This guide provides a detailed explanation of bank seeding meaning in Hindi, covering its importance, process, regulations, and more.

Understanding the Concept of Bank Seeding

Bank seeding is the foundational capital that gives a new bank the necessary financial strength to commence operations. This initial capital acts as a buffer against potential losses and allows the bank to build trust and confidence among its customers. It’s akin to planting a seed (hence the term “seeding”) which grows into a full-fledged tree (the bank). Without this initial investment, the bank would struggle to attract depositors and conduct lending activities.

Bank Seeding Process in India

Bank Seeding Process in India

Why is Bank Seeding Important?

Bank seeding is not merely a formality; it’s the backbone of a new bank’s stability and credibility. It provides a safety net for depositors, assuring them that their funds are safe. This initial capital also enables the bank to meet its operational expenses and invest in necessary infrastructure, such as technology and personnel. A well-capitalized bank is better equipped to handle financial shocks and contribute to the overall economic stability of the region it serves.

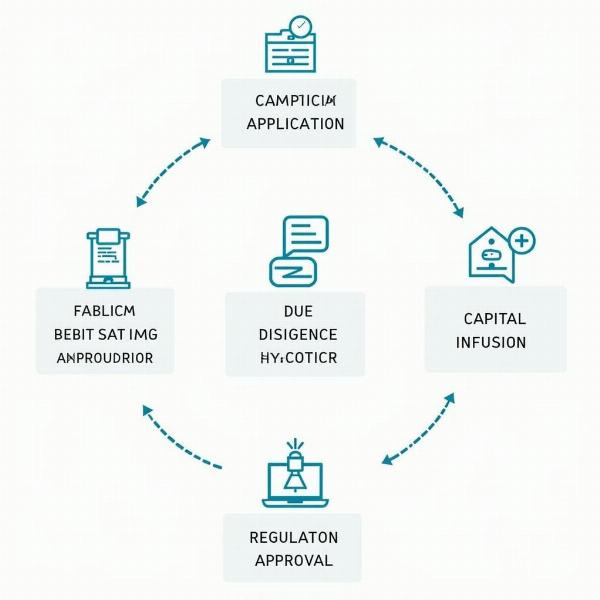

The Process of Bank Seeding in India

The Reserve Bank of India (RBI) plays a crucial role in regulating bank seeding in India. The process typically involves submitting a detailed proposal to the RBI, outlining the bank’s business plan, projected financials, and the source of the seed capital. The RBI conducts rigorous due diligence to ensure the viability and stability of the proposed bank. Once approved, the seed capital is infused, and the bank can commence operations under the RBI’s supervision.

Regulatory Framework for Bank Seeding

The RBI has established specific guidelines and regulations for bank seeding to maintain the integrity and stability of the financial system. These regulations dictate the minimum capital requirements, permissible sources of funding, and other crucial aspects of bank seeding. Adhering to these regulations is mandatory for any entity seeking to establish a new banking venture in India.

Bank Seeding and Financial Inclusion

Bank seeding plays a significant role in promoting financial inclusion. By facilitating the establishment of new banks, especially in underserved areas, it expands access to financial services for a larger population. This allows more individuals and businesses to participate in the formal economy, leading to greater economic growth and prosperity.

Conclusion

Bank seeding, or पूंजीकरण, is a vital aspect of establishing a new bank. It provides the necessary financial foundation for the bank to operate, build trust, and contribute to the economy. Understanding the meaning, importance, and process of bank seeding is crucial for anyone involved in the financial sector. A robust bank seeding process, regulated by institutions like the RBI, ensures the stability and growth of the banking system, ultimately benefitting individuals and the economy as a whole.

FAQ

- What is the minimum capital required for bank seeding in India? The minimum capital requirement can vary based on the type of bank and the RBI’s guidelines.

- Can foreign investors participate in bank seeding in India? Yes, foreign investors can participate subject to the RBI’s regulations on foreign investment in the banking sector.

- What are the key risks associated with bank seeding? Risks include regulatory hurdles, market volatility, and operational challenges.

- How does bank seeding contribute to economic growth? Bank seeding promotes financial inclusion and increases access to credit, stimulating economic activity.

- Where can I find more information on bank seeding regulations in India? The RBI website provides detailed information on regulations related to bank seeding.

- What is the difference between bank seeding and capitalization? While often used interchangeably, capitalization refers to the overall capital structure of a bank, while bank seeding specifically refers to the initial capital.

- What are the benefits of a well-capitalized bank? A well-capitalized bank is more resilient to financial shocks, can lend more effectively, and inspires greater confidence among depositors.

Meaning-Hindi.in offers specialized translation services catering to diverse industries, including financial and legal domains. We provide accurate and culturally sensitive translations for business documents, legal contracts, technical manuals, websites, and more. Our expertise in Hindi language and Indian culture ensures that your message is conveyed effectively and respectfully. Contact us today to discuss your translation needs. Email: [email protected], Phone: +91 11-4502-7584. Meaning-Hindi.in is your trusted partner for all your Hindi translation requirements.