MMID stands for Mobile Money Identifier. In Hindi, it is commonly referred to as मोबाइल मनी पहचानकर्ता (Mobil Mani Pahachanakarta). It is a seven-digit unique number issued by banks to customers who wish to use mobile banking services based on the IMPS (Immediate Payment Service) platform. This crucial number allows users to send and receive money instantly using their mobile phones, making transactions seamless and convenient.

Understanding MMID and Its Significance

What is the purpose of an MMID and why is it essential for mobile banking in India? An MMID acts like an address for your mobile banking account. When you want to transfer money using IMPS, you’ll need the recipient’s mobile number and MMID to complete the transaction. This system ensures secure and direct money transfers without the need for lengthy bank account details. This is particularly useful in a country like India, where mobile phone penetration is high and access to traditional banking services might be limited for some.

How to Obtain Your MMID

Getting your MMID is a straightforward process. You can generally obtain your MMID through the following methods:

- Internet Banking: Log in to your bank’s internet banking portal and navigate to the IMPS section. Your MMID should be displayed there.

- Mobile Banking App: If your bank has a dedicated mobile app, you can likely find your MMID within the app’s settings or profile section.

- SMS Banking: Some banks allow you to retrieve your MMID by sending a specific SMS code to a designated number.

- Bank Branch: You can always visit your local bank branch and request your MMID from a customer service representative.

Benefits of Using MMID for Transactions

Using MMID for IMPS transactions offers several advantages:

- 24/7 Availability: You can send and receive money anytime, anywhere, as long as you have internet access.

- Speed and Efficiency: IMPS transactions are processed instantly, unlike traditional NEFT or RTGS transfers.

- Security: MMID, combined with your mobile number, adds a layer of security to your mobile banking transactions.

- Accessibility: Even those without a smartphone can utilize MMID for basic banking transactions through SMS banking.

- Interoperability: MMID facilitates seamless transactions between different banks across India.

MMID and Other Mobile Banking Methods

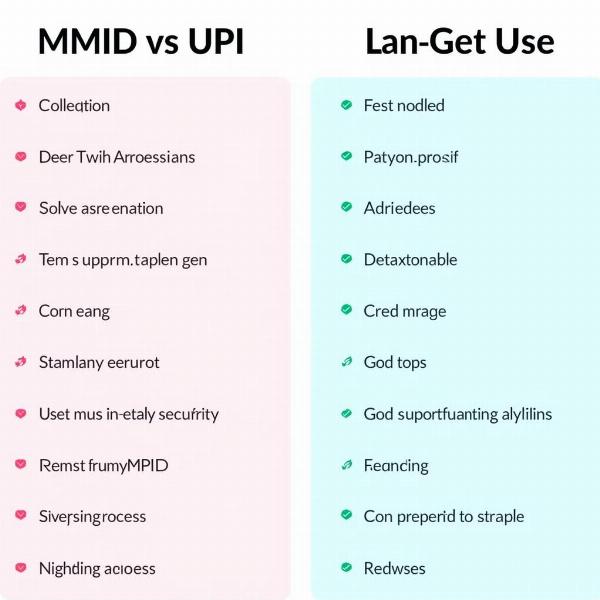

While MMID is widely used, it’s important to differentiate it from other mobile banking methods like UPI (Unified Payments Interface). UPI, unlike MMID, doesn’t require sharing your MMID or bank account details. UPI uses virtual payment addresses (VPAs) linked to your bank account, offering an even more convenient and secure way to transact.

Comparison of MMID and UPI payment methods

Comparison of MMID and UPI payment methods

Conclusion

MMID meaning in Hindi, or मोबाइल मनी पहचानकर्ता, is a vital component of the IMPS mobile banking system in India. Its simplicity and accessibility have made it a popular choice for countless individuals, empowering them to manage their finances on the go. While newer technologies like UPI are gaining traction, MMID continues to play a significant role in the Indian mobile banking landscape.

FAQ

- What is the full form of MMID? Mobile Money Identifier.

- Is MMID the same as my bank account number? No, MMID is a separate seven-digit number used specifically for mobile banking transactions.

- Can I have multiple MMIDs for the same bank account? Yes, you can typically have multiple MMIDs linked to a single bank account for different mobile devices.

- Is it safe to share my MMID? While it’s generally safe to share your MMID for transactions, it’s important to exercise caution and only share it with trusted parties.

- What should I do if I forget my MMID? You can retrieve your MMID through internet banking, mobile banking app, SMS banking, or by visiting your bank branch.

- Can I use MMID for international transactions? No, MMID is primarily used for domestic transactions within India.

- What is the difference between MMID and MPIN? MMID is used for identifying your mobile banking account, while MPIN (Mobile PIN) is a password used for authorizing transactions.

Related Articles

- defence services meaning in hindi

- in anticipation meaning in hindi

- eligible for counseling meaning in hindi

- finalist meaning in hindi

Meaning-Hindi.in is your premier destination for professional Hindi translation services. We specialize in a wide range of translation solutions, from business and legal documents to technical manuals and website localization. Our expert team ensures accurate and culturally sensitive translations, tailored to your specific needs. Contact us today for all your Hindi translation requirements at [email protected] or +91 11-4502-7584. Meaning-Hindi.in is committed to delivering high-quality language solutions to bridge communication gaps and facilitate seamless cross-cultural understanding.