Understanding the concept of a pre-approved personal loan can simplify your financial planning. A pre-approved personal loan essentially means a loan offer that’s already been sanctioned for you by a lender, based on their assessment of your creditworthiness and financial profile. This pre-approval often comes with a predetermined loan amount, interest rate, and tenure, making it a convenient and readily available funding option when needed. “Pre approved personal loan meaning in hindi” translates to “पूर्व-स्वीकृत व्यक्तिगत ऋण अर्थ हिंदी में”. Knowing what this means can save you time and effort when looking for quick financial assistance.

What Does Pre-Approved Personal Loan Mean?

A pre-approved personal loan signifies that a lender has evaluated your financial standing and is willing to offer you a loan without a full application process. This streamlined approach eliminates much of the paperwork and waiting time associated with traditional loan applications. While the final disbursement is subject to some basic verification, the bulk of the approval process is already complete. Factors like your credit score, income, and existing debt play a vital role in securing a pre-approved loan offer.

Benefits of a Pre-Approved Personal Loan

Pre-approved personal loans offer several advantages, particularly when you need funds quickly. The expedited process ensures faster access to funds, ideal for emergencies or time-sensitive expenses. Knowing your pre-approved loan amount allows for better financial planning and budgeting. Moreover, these loans often come with competitive interest rates, providing cost-effective borrowing options.

How to Get a Pre-Approved Personal Loan

Often, existing customers of a bank or financial institution receive pre-approved loan offers. Maintaining a healthy credit score, a consistent income stream, and a responsible debt repayment history significantly increases your chances of receiving such an offer.

Pre-Approved Loan vs. Regular Loan

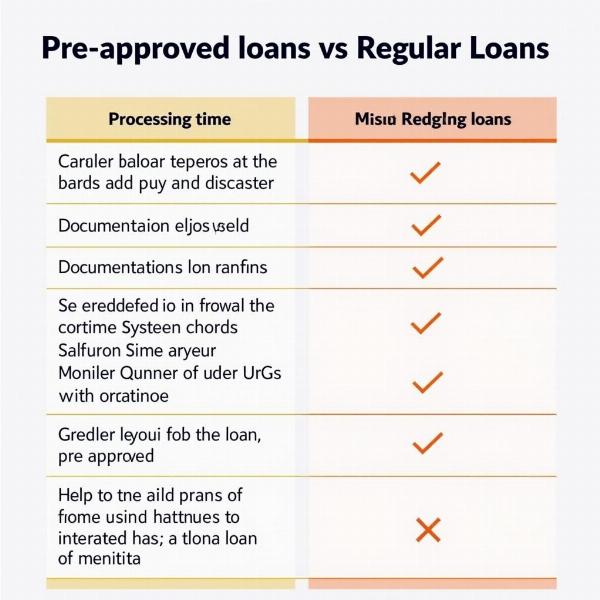

While both serve the purpose of providing funds, key differences exist between pre-approved and regular loans. Pre-approved loans offer quicker disbursal and simplified documentation, while regular loans require a more extensive application and approval process.

Is a Pre-Approved Loan Guaranteed?

While a pre-approved loan signifies a high probability of loan approval, it’s not a guaranteed sanction. Lenders might conduct further verification before final disbursal, which could influence the final loan terms.

Pre-Approved Loan vs. Regular Loan

Pre-Approved Loan vs. Regular Loan

Conclusion

Understanding “pre approved personal loan meaning in hindi” (पूर्व-स्वीकृत व्यक्तिगत ऋण अर्थ हिंदी में) equips you to make informed financial decisions. These loans offer a convenient and readily available source of funding, particularly for urgent needs. By maintaining a healthy financial profile, you can increase your chances of receiving a pre-approved loan offer, simplifying your borrowing experience.

FAQ

-

What is the meaning of pre-approved personal loan? A pre-approved personal loan is a loan offer extended by a lender based on your pre-existing financial relationship and creditworthiness.

-

How do I know if I have a pre-approved loan offer? Your bank may notify you via SMS, email, or phone call about pre-approved loan offers.

-

Is a pre-approved loan guaranteed? While not a guarantee, a pre-approved loan signifies a high likelihood of approval. Final disbursal is subject to further verification.

-

What factors affect pre-approval? Your credit score, income, existing debts, and relationship with the lender influence your pre-approval status.

-

What are the benefits of a pre-approved personal loan? Faster processing, simplified documentation, and access to funds in emergencies are key advantages.

-

Can I negotiate the interest rate on a pre-approved loan? While less common than with regular loans, negotiating the interest rate on a pre-approved loan might be possible in certain cases.

-

How can I increase my chances of getting a pre-approved loan? Maintaining a good credit score, steady income, and a responsible repayment history can improve your chances.

Meaning-Hindi.in is your one-stop solution for all your Hindi translation needs. We offer a wide range of translation services, specializing in business and commercial documents, legal and certified translations, technical manuals, website localization, educational and academic materials, and urgent translations. Our expertise also extends to various specialized fields. Whether you need to translate your financial documents or legal agreements, Meaning-Hindi.in provides accurate and culturally sensitive translations, ensuring your message resonates effectively with your target audience. Contact us today for all your Hindi translation needs at [email protected] or call us at +91 11-4502-7584.