Reconciliation statement meaning in Hindi is “मेल-मिलाप विवरण” (mel-milaap vivaran). Understanding the meaning and purpose of a reconciliation statement is crucial for effective financial management, whether for personal finances or business operations. This guide will delve into the details of reconciliation statements, exploring their significance, types, and practical applications.

What is a Reconciliation Statement?

A reconciliation statement, also known as a reconciliation report, is a document that compares two sets of records to identify any discrepancies. It helps to ensure that two related records are consistent and accurate. Think of it as a check and balance system for your finances. This is especially important in businesses where multiple transactions occur daily. Whether it’s bank reconciliation or vendor reconciliation, the underlying principle remains the same: verifying accuracy and identifying discrepancies.

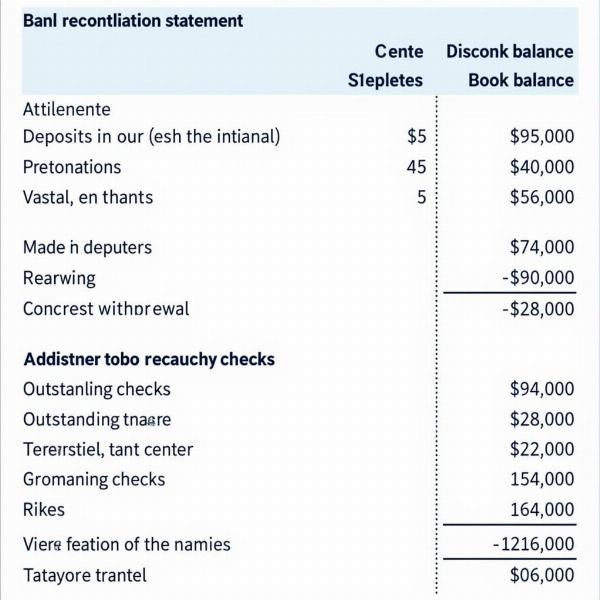

Bank Reconciliation Statement Example

Bank Reconciliation Statement Example

Types of Reconciliation Statements

Various types of reconciliation statements serve different purposes. Some common ones include:

- Bank Reconciliation: This compares a company’s bank statement with its internal cash records. This helps identify unrecorded transactions, errors, and bank charges.

- Vendor Reconciliation: This compares a company’s accounts payable records with the vendor’s invoices. It helps identify discrepancies in payments and outstanding invoices.

- Customer Reconciliation: This compares a company’s accounts receivable records with the customer’s payment records. It helps identify outstanding payments and resolve billing disputes.

- Intercompany Reconciliation: This compares transactions between different entities within the same company group. It ensures accuracy and proper accounting across all subsidiaries.

Why are Reconciliation Statements Important?

Reconciliation statements play a vital role in maintaining financial integrity and accuracy. They help to:

- Identify Errors: Human error is inevitable. Reconciliation statements can pinpoint these errors in accounting records.

- Prevent Fraud: Regularly reconciling accounts can deter fraud by uncovering unauthorized transactions.

- Improve Financial Management: Reconciling statements provides valuable insights into cash flow and helps improve financial planning and decision-making.

- Ensure Compliance: Reconciliation is essential for complying with regulatory requirements and internal controls.

How to Prepare a Reconciliation Statement

While specific steps may vary depending on the type of reconciliation, the general process includes:

- Gather the Necessary Documents: Collect all relevant records, such as bank statements, invoices, and internal accounting records.

- Compare the Records: Carefully compare the two sets of data, identifying any differences.

- Investigate Discrepancies: Determine the cause of any discrepancies. This might involve checking for missing transactions, errors in data entry, or timing differences.

- Make Adjustments: Adjust the records as needed to correct any errors or omissions.

- Document the Reconciliation: Maintain a record of the reconciliation process, including all adjustments and supporting documentation.

Practical Example: Bank Reconciliation

Imagine your company’s bank statement shows a balance of ₹10,000, but your internal records show ₹9,000. A bank reconciliation might reveal an outstanding check of ₹1,000 that hasn’t yet cleared the bank. This reconciles the difference between the two balances.

Conclusion: The Value of Reconciliation

Understanding the “reconciliation statement meaning in Hindi” (मेल-मिलाप विवरण – mel-milaap vivaran) and its practical application is fundamental for sound financial management. By implementing regular reconciliation practices, individuals and businesses can maintain accurate records, prevent fraud, and make informed financial decisions.

FAQ

- What is the main purpose of a reconciliation statement? The main purpose is to identify and explain the differences between two sets of related financial records.

- How often should reconciliations be performed? This depends on the volume of transactions and the specific needs of the business. Monthly reconciliation is common, but some businesses may reconcile daily or weekly.

- What are some common reasons for discrepancies in a bank reconciliation? Common reasons include outstanding checks, deposits in transit, bank errors, and bank charges.

- Is reconciliation software available? Yes, various software programs can automate and simplify the reconciliation process.

- Who is responsible for preparing reconciliation statements? Typically, accounting or finance personnel are responsible for this task.

- What is the difference between a reconciliation statement and an account statement? An account statement is a summary of transactions provided by a financial institution, while a reconciliation statement compares that statement to internal records.

- How can I improve the accuracy of my reconciliation process? Maintaining organized records, using accounting software, and implementing strong internal controls can improve accuracy.

Meaning-Hindi.in is your trusted partner for professional Hindi translation services. We specialize in various translation areas, including business and commercial documents, legal and certified translations, technical manuals, website localization, and academic papers. Our expertise in financial terminology ensures accurate and reliable translations for your reconciliation statements and other financial documents. Contact us today for a free quote! Email: [email protected], Phone: +91 11-4502-7584. Meaning-Hindi.in is your one-stop solution for all your Hindi translation needs.