Understanding the concept of broken period interest is crucial, especially when dealing with financial matters. “Broken period interest,” often encountered in loan repayments or investments, refers to the interest calculated for a non-standard duration, a period that is less than a full regular compounding period. This article will delve into the meaning of broken period interest in Hindi, its calculation, practical applications, and related terms.

What Does Broken Period Interest Mean?

Broken period interest, translated as “टूटी अवधि ब्याज” (Tooti Avadhi Byaj) in Hindi, signifies the interest accrued on a principal amount for a duration shorter than the typical compounding period. Imagine your loan interest is compounded annually, but you decide to make a part-payment after just six months. The interest calculated for these six months is the broken period interest. It ensures fair calculation of interest charges or earnings for any incomplete period.

How is Broken Period Interest Calculated?

The calculation of broken period interest depends on the interest rate and the length of the broken period. A simple method involves calculating the interest for the entire compounding period and then proportionally dividing it based on the broken period’s length. However, financial institutions may employ more complex methods based on their specific terms and conditions.

Understanding Simple and Compound Interest in the Context of Broken Periods

Simple interest for a broken period is straightforward. It’s a direct fraction of the annual interest, proportional to the fraction of the year represented by the broken period. Compound interest for a broken period gets a bit trickier. Some institutions might simply calculate the interest for the complete period and then prorate it. Others might apply a daily or monthly compounding rate to calculate the broken period interest more precisely. This distinction becomes especially important in long-term loans or investments.

Practical Applications of Broken Period Interest

Broken period interest is frequently applied in scenarios like:

- Premature loan repayments: When you pay off a loan earlier than scheduled, the interest for the period between your last payment and the full repayment date is calculated as broken period interest.

- Investments with variable terms: Certain investments allow withdrawals or additions at irregular intervals. The interest earned for these irregular periods constitutes broken period interest.

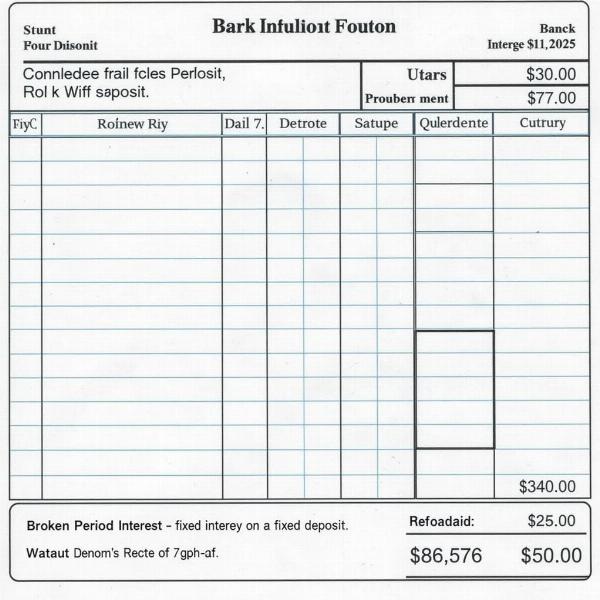

- Fixed deposits with premature withdrawals: If you withdraw from a fixed deposit before maturity, the interest for the period up to the withdrawal date is considered broken period interest.

Broken Period Interest in Fixed Deposits

In India, fixed deposits are popular investment instruments. Understanding broken period interest is essential for maximizing returns when dealing with premature withdrawals. The rate of interest applicable for a broken period might be lower than the contracted rate for the full term of the deposit, potentially impacting your overall return.

Broken Period Interest in Fixed Deposits

Broken Period Interest in Fixed Deposits

Related Terms: Accrued Interest and Pro-Rata Interest

Accrued interest and pro-rata interest are closely related to broken period interest. Accrued interest represents the interest earned but not yet paid. Pro-rata interest is the proportional allocation of the total interest for a given period based on a specific fraction of that period, similar to the calculation of broken period interest.

Conclusion

Understanding “broken period interest” (टूटी अवधि ब्याज) is crucial for making informed financial decisions. Whether you’re dealing with loans, investments, or fixed deposits, knowing how this interest is calculated can help you maximize returns and minimize costs. This knowledge empowers you to navigate the complexities of financial instruments and make choices that best serve your financial goals.

FAQ

- What is broken period interest in simple terms? It’s the interest calculated for a period shorter than the regular compounding cycle.

- Why is broken period interest important? It ensures fair calculation of interest for incomplete periods.

- How does broken period interest affect fixed deposits? It determines the interest earned when withdrawing before maturity.

- Is broken period interest the same as accrued interest? No, accrued interest is the earned but unpaid interest, while broken period interest is for a shorter than usual period.

- Where can I learn more about broken period interest? Consult your financial advisor or refer to the terms and conditions of your financial products.

About Meaning-Hindi.in

Meaning-Hindi.in is your trusted partner for accurate and reliable Hindi translation services. We specialize in a wide range of translation solutions, including business and commercial documents, legal and certified translations, technical manuals, website localization, educational and academic materials, and expedited translation services. Our expertise in financial terminology ensures precise and culturally sensitive translations for all your needs. Contact us today for professional Hindi translation services that bridge language barriers and connect you with your target audience. Email: [email protected], Phone: +91 11-4502-7584. Meaning-Hindi.in is committed to delivering high-quality translations that meet your specific requirements.