Understanding the concept of “primary insured” is crucial in the world of insurance, especially when dealing with policies in India. Whether you’re navigating a business insurance policy or a personal one, knowing who the primary insured is can significantly impact your coverage and claims process. This guide will delve into the “primary insured meaning in hindi,” providing clarity and practical examples to help you grasp this essential insurance term.

Who is the Primary Insured? (प्राथमिक बीमित व्यक्ति कौन है?)

The primary insured (प्राथमिक बीमित) is the individual or entity named first on an insurance policy and bears the most significant responsibility. They have the power to make changes to the policy, add or remove other insured parties, and are ultimately responsible for premium payments. While others might be covered under the same policy, the primary insured holds the primary control. This distinction is particularly relevant in India where joint ownership or family-based policies are common.

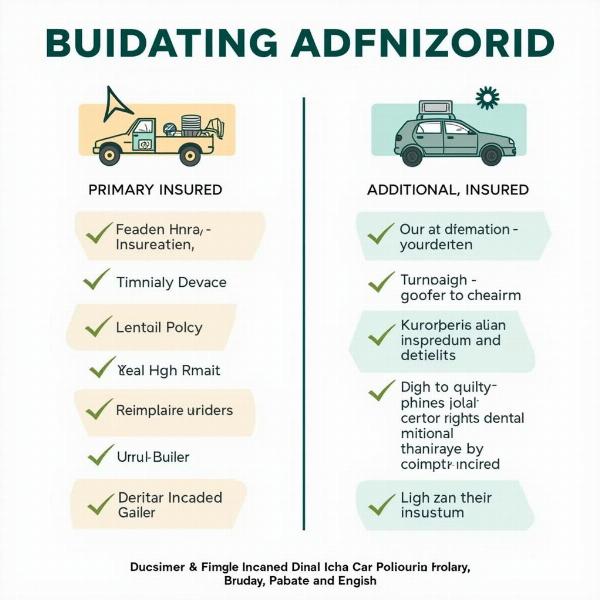

Difference Between Primary Insured and Additional Insured (प्राथमिक बीमित और अतिरिक्त बीमित के बीच अंतर)

It’s essential to distinguish between the primary insured and an additional insured (अतिरिक्त बीमित). While the primary insured has all the control and responsibilities, an additional insured is typically covered under the primary policy for specific situations or liabilities. For example, in a car insurance policy, the primary insured is the car owner, while other family members listed on the policy might be considered additional insureds. They are covered to drive the vehicle, but don’t have the same rights and responsibilities as the primary insured.

Primary vs. Additional Insured in Car Insurance

Primary vs. Additional Insured in Car Insurance

Why is Understanding Primary Insured Important? (प्राथमिक बीमित को समझना क्यों महत्वपूर्ण है?)

Knowing who the primary insured is is crucial for several reasons:

- Claims Process: The primary insured is the main point of contact for the insurance company during the claims process. They are authorized to file claims and make decisions regarding settlements.

- Policy Modifications: Only the primary insured can make changes to the policy, such as updating coverage amounts, adding or removing drivers, or changing the address.

- Premium Payments: The primary insured is responsible for paying the insurance premiums.

- Legal Responsibility: In many cases, the primary insured is legally responsible for ensuring the policy is maintained and premiums are paid.

Primary Insured in Different Insurance Types (विभिन्न बीमा प्रकारों में प्राथमिक बीमित)

The concept of primary insured applies across various insurance types, although the specific implications may vary.

- Health Insurance: In health insurance, the primary insured is typically the individual whose health is being covered.

- Life Insurance: The policyholder is the primary insured in life insurance, responsible for paying premiums and designating beneficiaries.

- Business Insurance: For businesses, the primary insured is the company or organization itself.

Practical Examples of Primary Insured (प्राथमिक बीमित के व्यावहारिक उदाहरण)

Let’s consider some practical examples to solidify the understanding of “primary insured”:

- Scenario 1: Rahul buys a car and gets it insured. He is listed as the primary insured on the policy. His wife, Priya, is also listed on the policy as an additional insured. Rahul is responsible for paying the premiums and managing the policy. Priya can drive the car and is covered under the policy, but she cannot make changes to it.

- Scenario 2: A small business, “Sharma Enterprises,” takes out a liability insurance policy. Sharma Enterprises is the primary insured. The policy covers the business against potential lawsuits.

Conclusion

Understanding “primary insured meaning in hindi” (प्राथमिक बीमित का अर्थ) is essential for anyone navigating the insurance landscape in India. Whether you’re an individual or a business owner, recognizing the roles and responsibilities of the primary insured can empower you to manage your insurance policies effectively and ensure you receive the proper coverage and support when needed.

FAQ

- Who is the primary insured on a car insurance policy? The primary insured is typically the owner of the vehicle and the person who purchased the insurance policy.

- Can an additional insured file a claim? Yes, an additional insured can often file a claim, but the primary insured usually has the ultimate authority in the claims process.

- What happens if the primary insured passes away? The policy typically transfers to a designated beneficiary or the estate.

- Can the primary insured be changed? Yes, the primary insured can usually be changed with the consent of the insurance company.

- Why is it important to distinguish between primary and additional insureds? This distinction clarifies responsibilities and rights regarding policy management, claims, and premium payments.

- Is the primary insured always responsible for premium payments? Yes, generally, the primary insured is responsible for paying the insurance premiums.

- Can a minor be a primary insured? Generally, no. A minor cannot enter into a legal contract like an insurance policy.

Meaning-Hindi.in is your trusted partner for all your Hindi translation needs. We specialize in a wide range of translation services, from business and legal documents to technical manuals and website localization. Our team of expert translators ensures accurate and culturally sensitive translations, helping you bridge the communication gap effectively. Whether you need business document translation, legal document translation, or technical manual translation, our expertise covers it all. Contact us today at [email protected] or call us at +91 11-4502-7584 for a seamless translation experience. Let Meaning-Hindi.in be your gateway to accurate and reliable Hindi translation.